About Charlwood Leigh

- Philosophy

- About Our Clients

- Funds Under Management

- UK Financial History 1945-1998

Philosophy

For over 30 years now, Charlwood Leigh have prided ourselves on the professional and personal approach to our clients’ finances. Your wealth is our concern and we do our best to help you to increase your wealth and protect it for your family and your future.

We have always been fiercely independent and can help you to invest in a wide range of plans from any provider in the market place. After all, how else could you benefit from our independence?

Our service to our clients is second to none, with high standards of technical expertise, as well as fast processing of applications and claims. Although we do provide a web site, if you need to talk, there is always someone who you can reach on the phone.

That is why, since 1966 we have retained clients who were with us when the Company was formed and are now looking after third generation clients, the grandchildren of those who have invested their trust in us over more than 30 years.

Charlwood Leigh’s clients range over a wide spectrum of individuals and companies.

We look after senior lawyers and accountants, as well as young entrepreneurs setting up in business for the first time. We also look after young families, who simply want to protect their lifestyle or start to build a nest-egg for the future.

Amongst our corporate clients, we can boast a number of well-known household names, many of whom we have now looked after for many years.

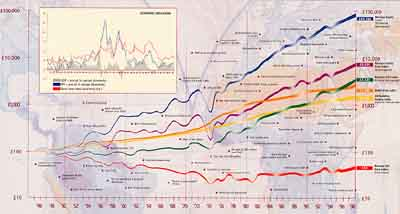

Funds Under Management

Charlwood Leigh has helped its clients to invest over £500 million in to pensions, unit trusts and mutual funds over the years. We review client investments on an annual basis, making any changes necessary, although our long-term philosophy is to buy good quality investments and hold them for a reasonable term of years.

It is time not timing that makes money in the investment business.

It is very hard to time a capital investment so that you put your money in the market just before it rises. Similarly if the market is “over-priced” according to the experts it may be foolish to wait for a crash as the crash may never come!

The only certainty is that equity investments tend to grow given sufficient time, and with the help of the best Fund Managers, which we will help you choose, over 5 years or more we are confident of impressive results for you.

UK Financial History 1945-1998

Click on the graph for a larger version.